In recent months, Trump railed against wind turbines and electric vehicles, which experts say would help curb climate pollution, and he threatened to claw back unspent climate funding. “It goes after pollution, not production,” Guilbeault said at a separate press conference, prompting a fiery response from the premier. Alberta will be hit hardest, it said, with 3.6% less investment, almost 70,000 fewer jobs, and a 4.5% decrease in GDP by 2040. It would reduce provincial revenues by up to $127 billion over the same period. A recent economic analysis by the Conference Board of Canada substantiated that claim, stating the cap may reduce Canada’s GDP by up to $1 trillion by 2040. It would also eliminate up to 151,000 jobs by 2030, and reduce federal revenues by $151 billion over that decade.

6: Preparing a Production Cost Report

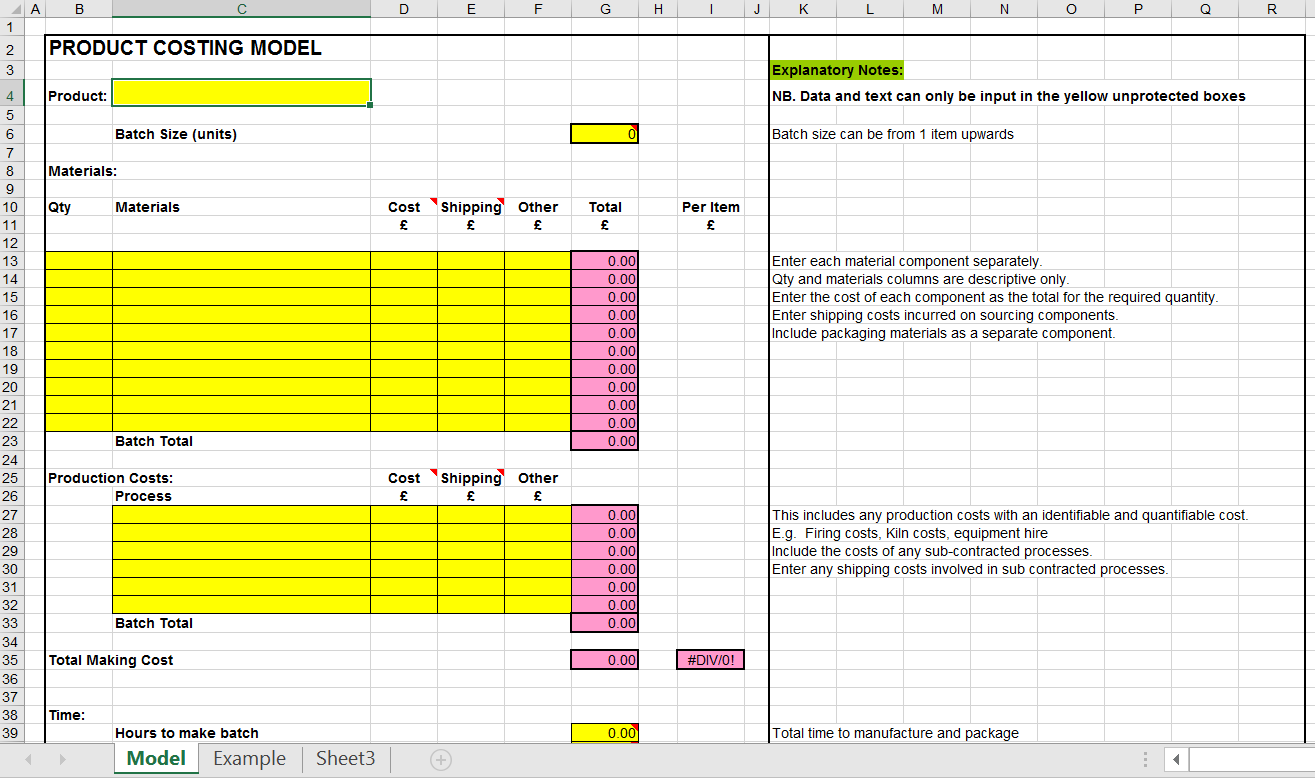

When reporting on production costs it should include all the expenses that have been incurred from manufacturing a product. That means direct costs, such as raw materials and labor, as well as indirect costs, such as rent and overhead. All of these costs are added up to come up with the total production costs.

How much will you need each month during retirement?

A production manager, however, might look at COGS to assess the efficiency of the production line. Meanwhile, an investor may interpret COGS as a measure of management’s ability to control costs and maintain margins. Equivalent units represent the number of complete units that could have been produced from the total amount of work done, considering both the completed units tips for sales tax compliance in e and the partially completed units in the production process. Multiply the cost per equivalent unit by the number of equivalent units for each category of units accounted for. Job-order costing is used when there is production of a variety of products or for one time jobs. This system records costs at the time they are incurred and it is easier to have control over the job.

Managerial Accounting

- Some costs will not change at all with a change in sales volume (e.g., monthly rent for the production facility).

- Production downtime refers to the time a factory’s assembly lines aren’t operating.

- A financial analyst might use COGM as a key indicator of a company’s efficiency.

- It’s calculated by dividing the total number of good units produced by the specific time frame.

Meanwhile, a strategic planner views the CPR as a map, guiding long-term investments and the scaling of production capacities. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with… Trump is also expected to change how the U.S. engages in global efforts to deal with climate change. During his first term, Trump pulled the U.S. out of the Paris climate agreement, which requires virtually every country on Earth to pledge how much they’ll cut planet-warming pollution. Right now, world leaders are debating how to provide more climate funding to developing countries, which bear little responsibility for causing global warming but are suffering disproportionately from its impacts.

Is there any other context you can provide?

Production reports are tracking efficiency and one way to improve efficiency is by planning resources better. Capacity planning helps production managers determine how much production capacity is needed to meet the demand for their products. Use this free production capacity planning template for Excel to help meet the constantly fluctuating demand. Use this free production schedule template for Excel to make a plan that balances the supply and demand in the production of goods over a period. This flexible template can respond to demand fluctuations and helps avoid inventory stockouts. Production reports are only one piece of the larger picture that makes up manufacturing and the management of those processes required to create a commodity.

Not only do they streamline payroll, but they provide visibility into how far each team member is in completing their tasks. For a high-level overview of production costs, use the real-time dashboard. Before monitoring manufacturing KPIs with a production report, production managers can set the stage for a successful project by making a production schedule. Tasks, resources and costs can be organized on the Gantt chart or sheet view, which is simply a Gantt chart without a timeline.

It includes material costs, direct labor, and overhead directly tied to the production process. By dissecting COGS, stakeholders can glean insights into the efficiency of production, the pricing strategy, and ultimately, the profitability of the products. It’s not just a line item on the income statement; it’s a window into the operational heartbeat of a company. Understanding the key components of a Cost of Production Report is crucial for any manufacturing business aiming to streamline its operations and maximize profitability.

It directly influences pricing strategies, profit margins, and decision-making processes. By meticulously analyzing production costs, manufacturers can identify inefficiencies, optimize resource allocation, and enhance product value. This section delves into the multifaceted nature of production costs from various perspectives, offering a comprehensive examination of how they shape the manufacturing landscape. Work-in-progress (WIP) is the cost of unfinished goods in the manufacturing process. This includes all your production costs such as the costs of direct labor, raw materials and manufacturing overhead.

It’s a balance between precision and practicality, ensuring that the cost of production report is a useful tool for decision-making. We have 4,000 total units for which to account, with 750 in process at the beginning of the month, and the last batch that is still in process at the end of the month will be 1,000 shells once it is done. On the last day of February, it was only 25% through the process, meaning that the EUs for ending inventory for direct materials was 1,000 units and for conversion costs was 25% of 1,000 units which is 250 EUs.

Greenhouse gas emissions, which trap heat and mainly come from burning fossil fuels, reached an all-time high last year. In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory. This is where equivalent units are different than the normal formula, but only for beginning inventory. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Leave A Comment